gift in kind tax receipt

To receive a tax deduction the donor. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Go to IRSgovOrderForms to order current forms instructions and publications.

. Under a Will or by way of inheritance. Call 800-829-3676 to order prior-year forms and instructions. Ask to Buy is a feature that allows an Organizer to approve Transactions initiated by a Family member under age 18 or the equivalent age of majority in your Home.

Beginning after December 31 2017 section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment other than real property held primarily for sale. Blow and Go Ch. You will be required to provide a tax receipt.

During the 2015 to 2016 tax year basic rate of tax 20 a donor Mr Green who only pays a small amount of Income Tax each tax year wins a tax free cash prize of 10000 in a competition. Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. A gift certificate or an equivalent item as an award for length.

Updated June 03 2022. Ordering tax forms instructions and publications. The IRS will process your order for forms and publications as soon as possible.

Each charitable institution will send you a tax receipt prior to the income tax due date of your total donations for the tax year. Your recordkeeping system should include a summary of your business transactions. Referring client will receive a 20 gift card for each valid new client referred limit two.

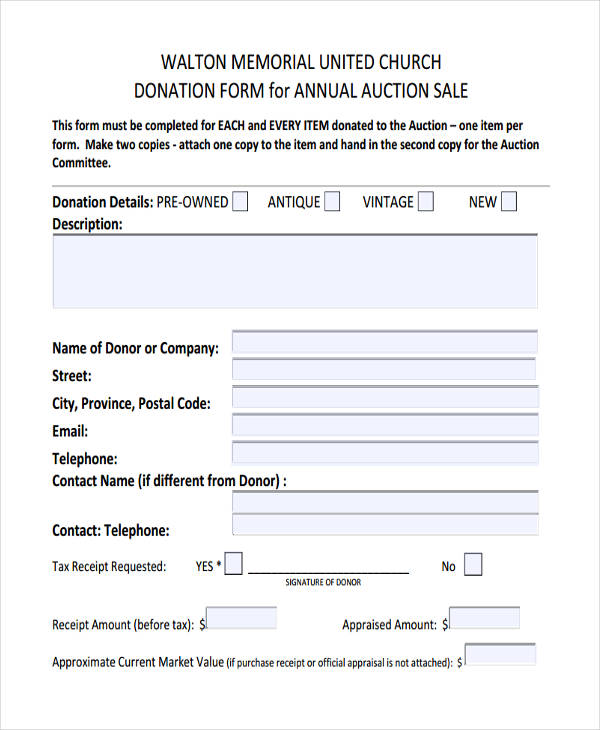

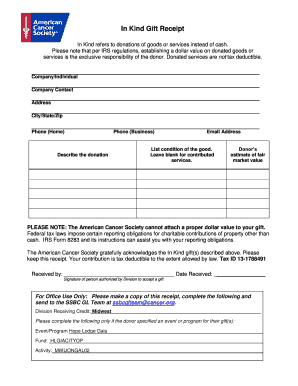

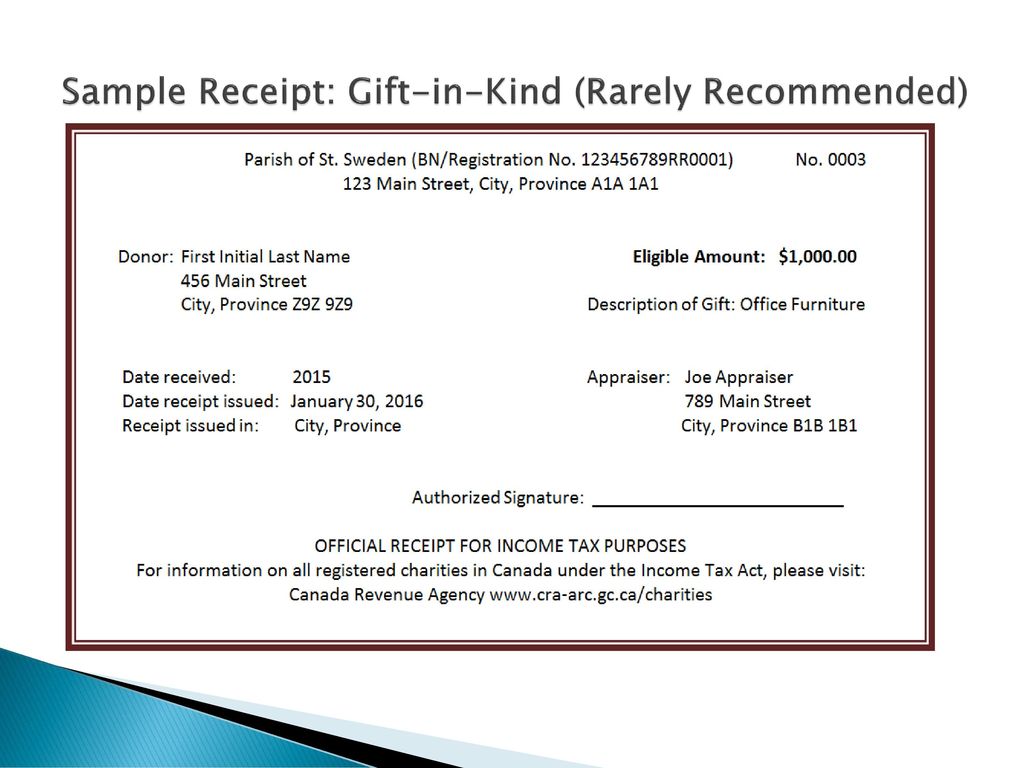

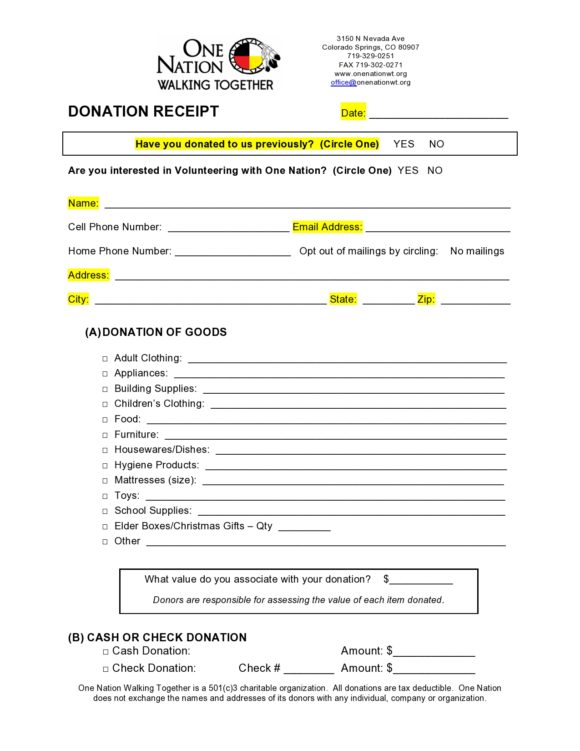

For non-cash gifts-in-kind contributions with a claimed value of 5000 donors generally need an appraisal. Blow and Go 467 A short story about a quick blow job. Ordering tax forms instructions and publications.

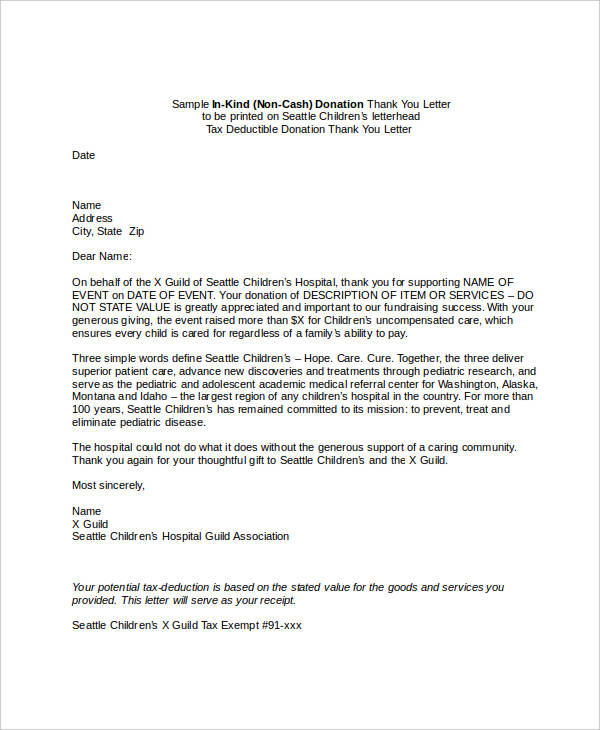

Blow and Go Ch. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. But you dont need to include language about the gift being tax-deductible because the DAF already provided a tax receipt to the donor.

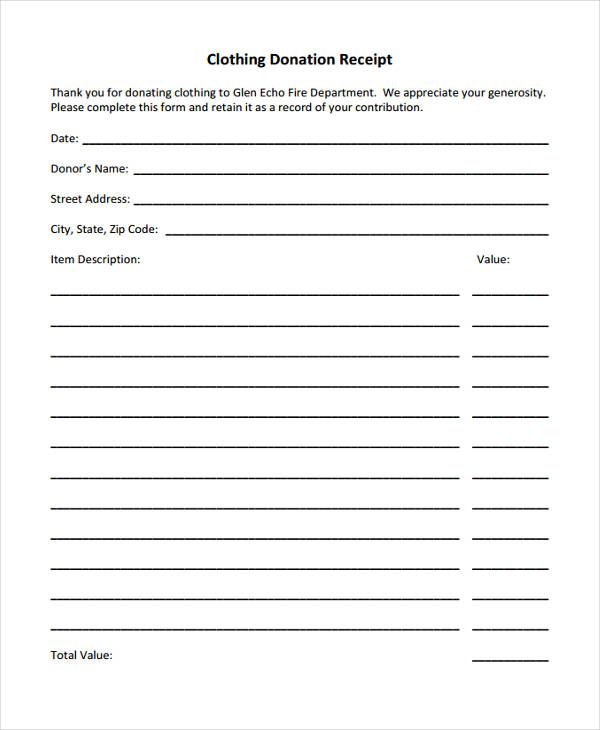

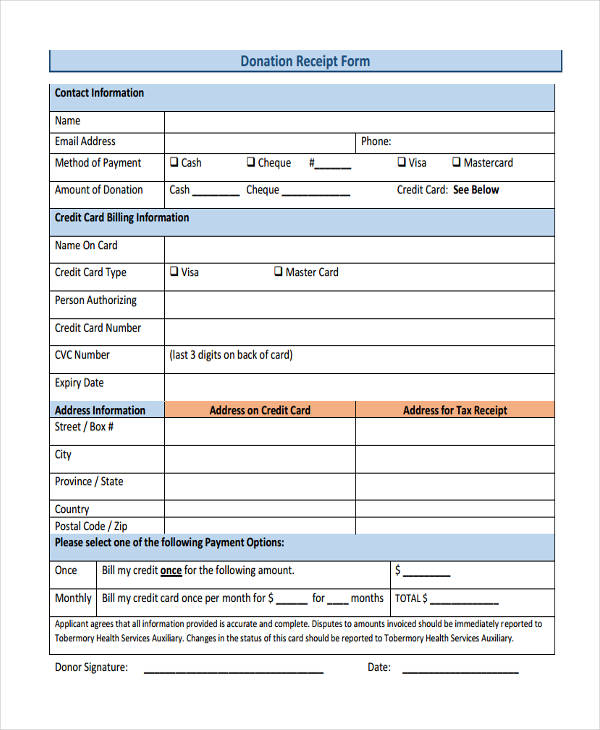

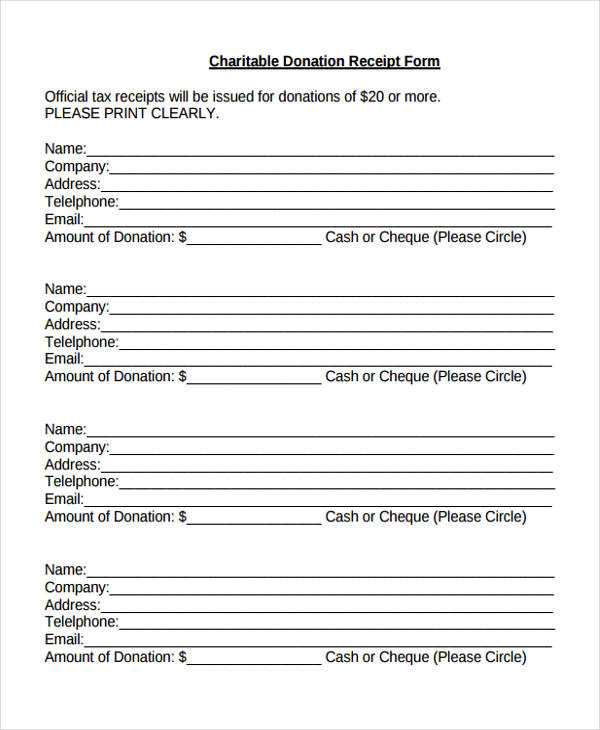

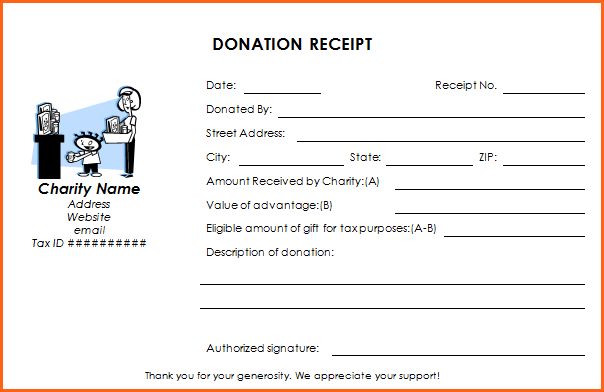

Unrivaled access premier storytelling and the best of business since 1930. Whatever the form every receipt must include six items to meet the standards set. Your kind of business may determine if a particular activity is.

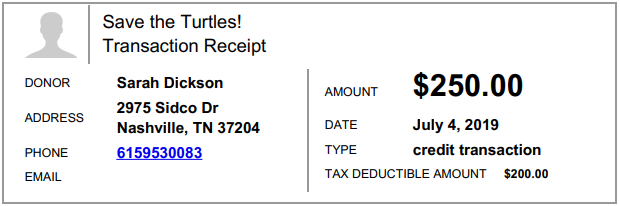

A receipt or invoice for any Family member Transaction is sent to the initiating Family member and if billed to the Organizers payment method also to the Organizer. 501c3 Tax-Compliant Donation Receipt Requirements. The empty string is the special case where the sequence has length zero so there are no symbols in the string.

The sports equipment drive got a good response and people donated enough to create a practice library of equipment that kids could take home to work on their skills. The latest Lifestyle Daily Life news tips opinion and advice from The Sydney Morning Herald covering life and relationships beauty fashion health wellbeing. A receipt with a valid transaction number is required to receive a refund on sales tax for returned items within the time period allowed by law in Connecticut Massachusetts and Rhode Island.

The IRS will process your order for forms and publications as soon as possible. 02 473 Finding a suck buddy. A story of a different kind of summer love.

Gift received On occasion of the marriage of the individual Gift received by any person without limit on the occasion of the marriage is tax free in the hands of the individual. Statement that the organization is a 501c3 tax-exempt organization. Formally a string is a finite ordered sequence of characters such as letters digits or spaces.

With her new gift acceptance policy and in-kind strategy Arielle was able to grow her programs and build the community around her organization. And Gift Expenses If you deduct travel entertainment gift or transportation expenses you must be able to prove substantiate certain elements. From stock market news to jobs and real estate it can all be found here.

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation. For example a business may choose to donate computers to a school and declare that donation as a tax deduction. Gifts and income tax.

Go to IRSgovOrderForms to order current. Include the nonprofits EIN so the the donor can to check the charitys tax-exempt status. Get breaking Finance news and the latest business articles from AOL.

Clothing Shoes Jewelry. The business you are in affects the type of records you need to keep for federal tax purposes. Call 800-829-3676 to order prior-year forms and instructions.

Referred client must have taxes prepared by 4102018. We advise that organizations provide written acknowledgment to donors in a timely manner as close to the receipt of the gift as possible. Keep in mind that CRA might request a proof of the donations since charitable donations are on the top of the list for post-assessments.

If your friend or relative or any other person gifts you on your marriage then nothing will be taxable. Be informed and get ahead with. Go to IRSgovOrderForms to order current forms instructions and publications.

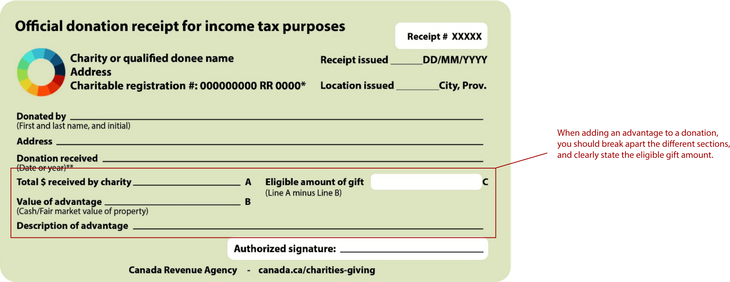

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition assessment and collection of the federal income tax violates the United States ConstitutionThese kinds of arguments though related to are distinguished from statutory and administrative arguments which presuppose the constitutionality of the income tax as well as. Ordering tax forms instructions and publications. If you made a gift of money or other property to a qualified donee see Gifts to registered charities and other qualified donees you may be able to claim federal and provincial or territorial non-refundable tax credits when you file your income tax and benefit return provided that you receive an official donation receipt from the qualified donee.

Otium Bluetooth HeadphonesWireless Earbuds IPX7 Waterproof Sports Earphones with Mic HD Stereo Sweatproof in-Ear Earbuds Gym Running Workout 10 Hour Battery Noise Cancelling Headsets. Walmart reserves the right to limit or decline returns or exchanges regardless of whether the customer has a receipt. 03 475 Suck buddies become fuck buddies.

As a result donors expect a nonprofit to provide a receipt for their contribution. The receipt can take a variety of written forms letters formal receipts postcards computer-generated forms etc. An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items.

Donation Thank You Letter 6 Free Word Pdf Documents Download Free Premium Templates

Donation Receipt Email Letter Templates For Your Nonprofit

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Donation Receipts Statements A Nonprofit Guide Including Templates

In Kind Donation Receipt Template Printable Pdf Word

Fillable Online Acsmwdcr Ejoinme In Kind Gift Receipt Acsmwdcr Ejoinme Org Fax Email Print Pdffiller

Donation Gift Receipt Quid Pro Quo Small Business Free Forms

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Treasurers Training Day Ppt Download

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Mastering The Donation Receipt Steal These Invaluable Tips Must Have Elements Templates By Miles Anthony Smith Medium

Silent Auction Donation Receipt Template Printable Pdf Word

Explore Our Image Of In Kind Donation Receipt Template Donation Letter Template Receipt Template Teacher Resume Template

30 Non Profit Donation Receipt Templates Pdf Word Printabletemplates

Generate And Send Customized Year End Tax Statements Receipts Little Green Light Knowledge Base

An Outline Of Donation Receipts And The Tax Deduction Process Cascade Business News